The impact on your pension

Your pension is calculated based on your gross earnings at the end of your career. When leasing a bicycle through your employer via a monthly gross salary exchange, it stands to reason that your gross salary might be a bit lower.

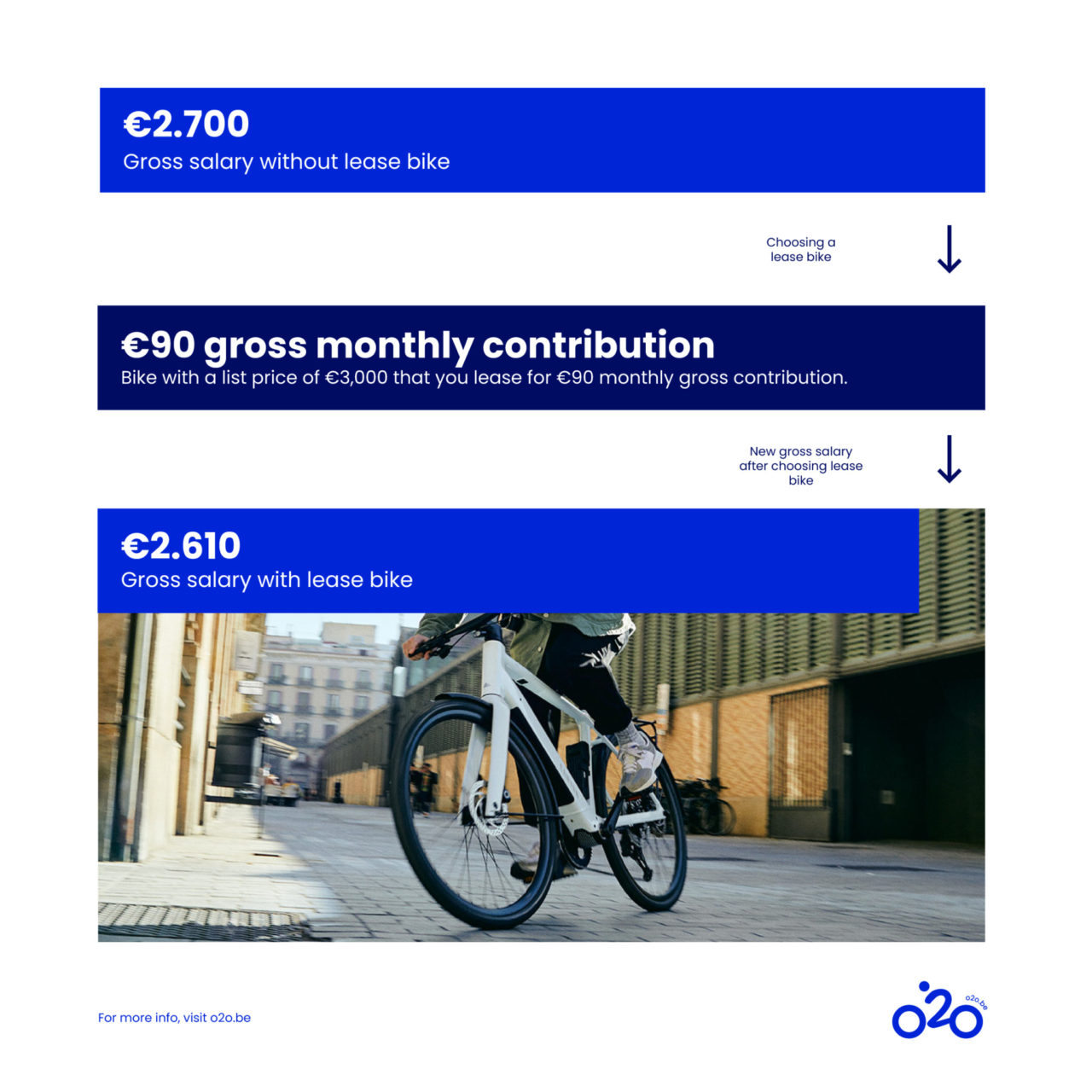

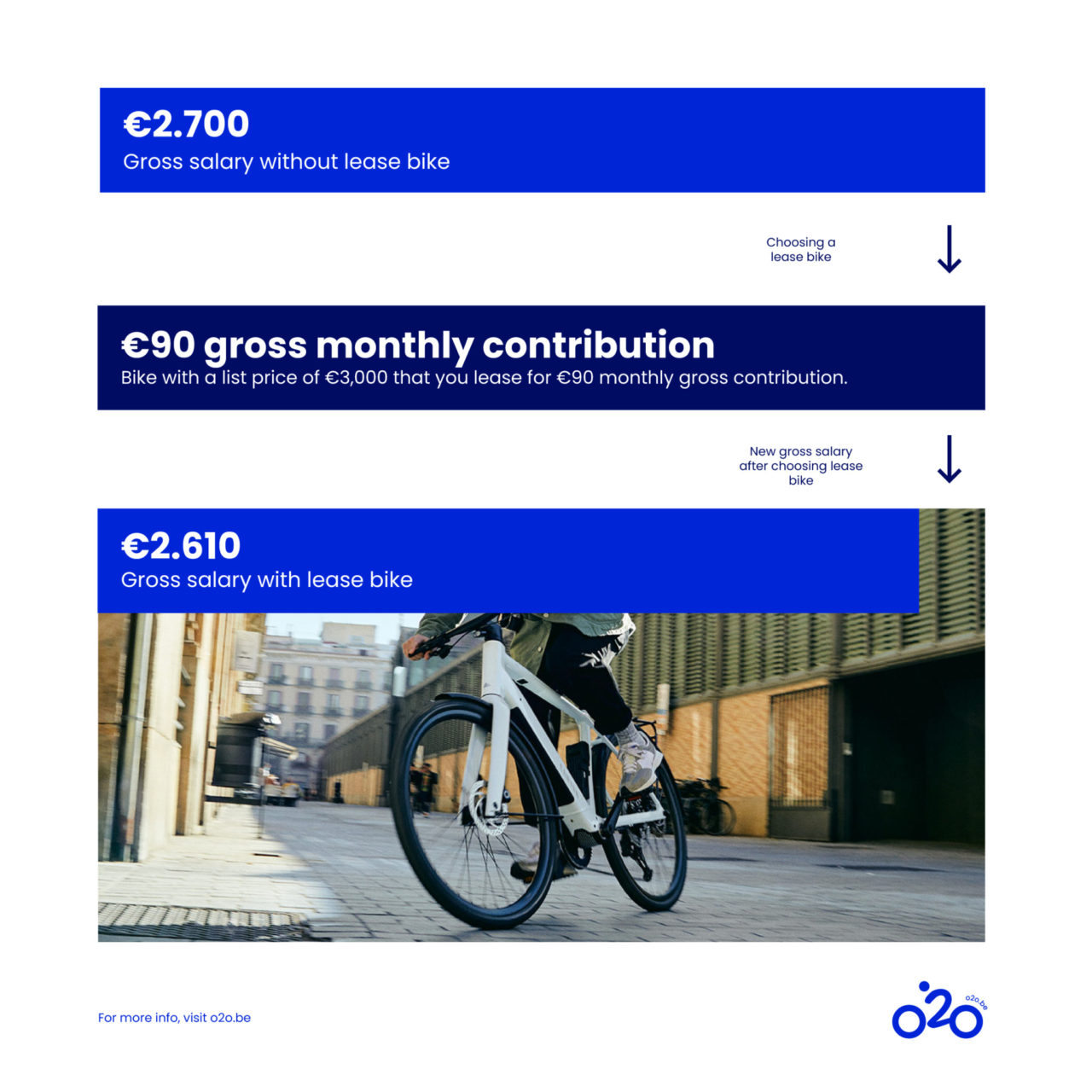

The figure below presents a simulation* of the impact of leasing a bicycle on a gross salary of €2,700. For an e-bike with a list price of €3,000, your gross lease contribution will be around €90 per month, which will slightly reduce your gross salary. Net, this comes to about €44. During your lease period (3 to 4-year contract), your pension contributions will therefore be calculated based on this lower gross salary.

* These amounts are simulations, real figures would depend on level of salary, lease contract and lease contribution from your employer. Services and insurances are included in the total amount.

But worry not, over the span of most of your career, leasing a bicycle will actually have very little impact on your eventual pension. For employees with higher salaries, in fact, their calculated pensions are actually capped. In such instances, bicycle leasing has no real effect.

Conclusion? The impact of leasing a bicycle via gross salary exchange on pensions is very much negligible. This is particularly true when you consider the net savings you make compared to buying privately. Because, at the end of the day, leasing a bicycle will cost you a lot less.

The impact on holiday pay and end-of-year bonus

When it comes to the impact on your holiday pay and end-of-year bonus, there are two possible scenarios:

- If you pay for your lease bicycle via monthly or hourly contribution, your holiday pay and end-of-year bonus will also be reduced accordingly. However, with the added fiscal benefit, you don’t end up making a loss as an employee.

- If you pay for your lease bicycle via your end-of-year bonus, your holiday pay will remain unchanged.

The impact on social benefits

- If you pay for your lease bicycle via monthly contributions, social benefits such as sick pay, maternity leave, unemployment benefit or workplace accident cover, will be calculated at your new, reduced gross salary.

- If you pay for your lease bicycle via your end-of-year bonus, your social benefits will remain unchanged.

Conclusion

Leasing a bicycle reduces your gross salary at the end of each month. Theoretically, therefore, you will indeed end up with a lower pension, less unemployment benefit, etc. However, thanks to the gross/net ratio, any impact based off of this is negligible.

On top of that, with bicycle leasing, you are making a sound decision due to the fiscal benefits and extra services often included within your leasing package. Add to that the positive impact of your daily commutes on your mental and physical health, the time saved and the sense of freedom you experience using your lease bicycle. Simply put, bicycle leasing is by far and away the best choice!

Not sure about your own personal situation? Then be sure to check in with your company’s HR department, who will be able to steer you in the right direction.

Want to lease a bicycle through your work?

Calculate how much it would cost to lease your dream bike with our handy simulator and find out instantly how much you would save in fiscal benefit savings.